Anyone Going to Lose Sleep Over No China Trade Deal?

THE WEEKEND ISSUE

Informing Investors Around The World

Read In All 50 States And Over 100 Countries

Weekend Newsletter for

May 12, 2019

Table Of Contents 1) MARKET SUMMARY from THE DAILY 2) STOCK SPLIT REPORT 3) IH ALERTS 4) SUCCESS TRADING GROUP 5) COVERED CALL SERVICE

1) MARKET SUMMARY > >From “The Daily” by Jon Johnson at InvestmentHouse.com

Friday came and went and all that the market got was more Chinese tariffs and a dud UBER IPO.

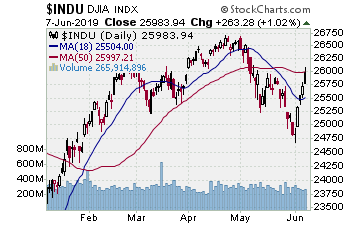

– More trade angst sends stocks lower, but stocks then rebound to close the week positive.

-More encouraging trade quotes from the administration turn stocks, or was it just that the indices made the technical tests of support we have discussed?

-So there is no trade deal with China. Anyone really going to lose sleep over it?

-CPI remains low-ish, and Powell may have to start wondering just how ‘transitory’ those prices are.

-Chips rebound but not as convincing as other leadership areas.

-Indices make the tests, leaders hold up quite well, will they now bounce to try the highs again?

Market Summary (continued)

Friday came and went and all that the market got was more Chinese tariffs and a dud UBER IPO. No trade deal, lots of market volatility, market selling — that was the week. On top of that, Saturday Trump proposed tariffs on ALL Chinese goods entering the US. Hey, if you are going to do it as a weapon, then do it. No half measures.

Okay, it was not all tariffs. After the President said there was ‘no need to rush’ on any trade deal, setting off more market weakness, he later noted that there could still be a deal. Then trade cheerleader Mnuchin chimed in that the Friday discussions, while just 2 hours, went very well.

After diving from the open to midmorning, that was enough — along with the prior market selloff to key support before — to rebound the market. Like the Thursday rebound the indices and leading stocks rebounded off the lows to hold key support with a nice doji with tail. Unlike the Thursday reversal off the lows, Friday the indices upped the ante, closing positive on the session.

Read “The Daily” Entire Weekend Summary

Watch Market Overview Video

Watch Technical Summary Video

Watch Next Session Video

Here’s a trade from “The Daily” and insights into our trading strategy:

Chart by StockCharts.com

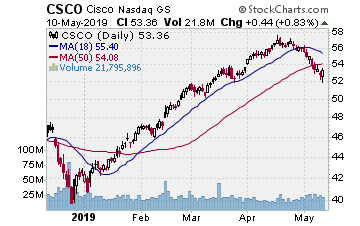

CSCO (Cisco Systems, Inc.)

Company Profile

CSCO looked rather toppy after hitting a higher recovery high but on no volume and fading MACD. Put on a downside play and on 5/2 entered as CSCO broke lower below the 20 day MA. Bought June $55.00 strike put options for $1.84. On Thursday 5/9 CSCO hit our initial target. As the indices were testing the 50 day MA and we anticipated a bounce from there, we banked the gain, selling the puts for $3.50. That gained a solid 90%.

MTCH (Match Group, Inc.)

Company Profile

We entered MTCH on 4/22 as it started higher out of a 10 week base formed at the 50 day EMA. Picked up the stock for $60.99 and some June $60 strike calls for $5.30. MTCH jumped initially, but stalled at $63. Faded to the 20 day EMA to test to start May, but then jumped Monday and made the big move Wednesday. That surge hit the initial target. We sold half the stock for $68.56, banking 12+%. Sold half the options for $9.40, banking 77%.

AXSM (Axsome Therapeutics, Inc.)

Company Profile

A relatively new stock, trading for 3 or so years, but only recently getting quite interesting. After a rally in March, AXSM started a lateral move late month on into April. It looked ready to make a new break after a nice test, so we put it on the report, and right after on 4/23, AXSM jumped the buy point. We moved in with stock at $15.89 and some June $15.00 strike call options at $3.60. A nice steady rise to late April, then a break higher this past week. Hit the target Tuesday and we sold half the stock for $19.41, banking 22%. Sold half the options for $4.6, banking a not so great 27%. Fortunately, AXSM continued higher Friday after a lateral move, surging over 6%. That should finally get the options pumped up some more.

Receive a 2 week trial and if you stay on receive a $30 per month discount!

2) STOCK SPLIT REPORT Here’s a leader play and our current analysis.

Chart by StockCharts.com

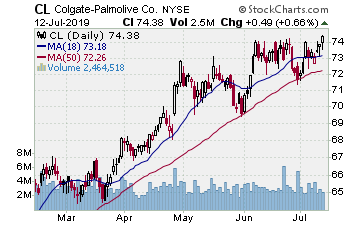

CL (Colgate-Palmolive–$71.50; +0.65; optionable)

Company Profile

EARNINGS: 07/26/2019

STATUS: Some money has left tech, no doubt about it. At the same time some of the other more stoic areas of the market are getting some money. Now they may not run 20 to 30 points in short order, but they can make us good money nonetheless because their options are so nicely priced. CL broke a downtrend from January 2018 to start February of this year. Took a bit to get going, but after some testing it rallied to end April, moving up to some prior price resistance. The past week it showed a really nice test to the 20 day EMA and started back up late week. We want to play the continued move higher. Using the August options that gains 65% — not huge but not bad for toothpaste and the like. Hey, if the money is moving there, let’s pick some of it up.

CHART VIDEO

Volume: 2.341M Avg Volume: 3.1M

BUY POINT: $71.59 Volume=4M Target=$75.65 Stop=$70.26

POSITION: CL AUG 16 2019 72.50C – (40 delta)

Learn more about our Stock Split Report and how we have made gains of 321% with our powerful stock split plays!

Save $360 per year on the Stock Split Report! Plus 2 week trial!

Chart by StockCharts.com

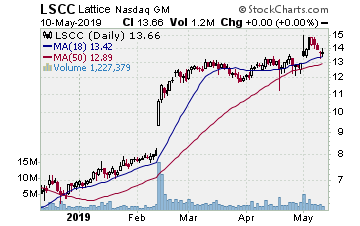

3) IH ALERTSLSCC (Lattice Semiconductor–$13.66; 0.00; optionable): Semiconductors

Company Profile

EARNINGS: 07/30/2019

STATUS: LSCC gapped higher out of a 10 week flat trading range on May 1 on earnings. Rallied through the prior week. In last week’s testing, LSCC faded to test the gap, holding the move out of the range. A pair of doji late in the week may or may not mean LSCC is ready to continue the breakout. The play is to wait to see LSCC break solidly higher again, and if so, we move in. A rally to the target gains 20% on the stock, 90%ish on the options.

CHART VIDEO

Volume: 1.227M Avg Volume: 1.77M

BUY POINT: $14.01 Volume=2.5M Target=$16.84 Stop=$13.07

POSITION: LSCC SEP 20 2019 15.00C – (49 delta) &/or Stock

Save $600 per year and enjoy a 2 week trial of our IH Alerts Service!

Chart by StockCharts.com

4) SUCCESS TRADING GROUP–by the MarketFN STG Team

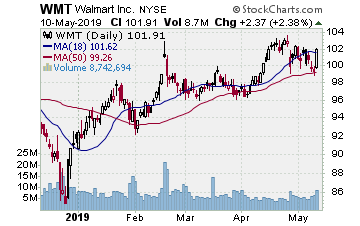

WMT (Walmart Inc.) Company ProfileOur Success Trading Group members will be looking to enter new positions next week. We have many stocks on our radar including Walmart, Inc. (Ticker: WMT) and New Jersey Resources Corp. (Ticker: NJR).

Our Success Trading Group closed7 years with 0 losses on our Main Trade Table. In fact, we closed 100% winning trades for the calendar years 2016, 2015, 2013, 2012, 2011, 2010 and 2009. All of these trades are posted on our Main Trade Table for your review during your free membership trial period.

Get Our Next Trade Free – Save $50 per month! Details Here.

Chart by StockCharts.com

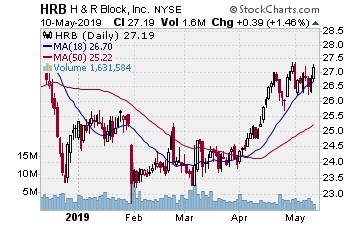

5) COVERED CALL PLAYHRB – H&R Block Inc. is currently trading at $27.19. The June $27.00 Calls (HRB20190622C00027000) are trading at $1.25. That provides a return of about 4% if HRB is above $27.00 on expiration Friday in June.