Embracing the Bear Market

THE WEEKEND ISSUE

Informing Investors Around The World

Read In All 50 States And Over 100 Countries

Weekend Newsletter for

December 23, 2018

Table Of Contents 1) MARKET SUMMARY from THE DAILY 2) STOCK SPLIT REPORT 3) IH ALERTS 4) SUCCESS TRADING GROUP 5) COVERED CALL SERVICE

1) MARKET SUMMARY > >From “The Daily” by Jon Johnson at InvestmentHouse.com

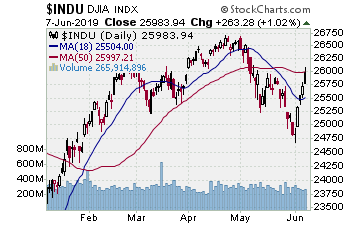

Stocks started higher, DJ30 rallied almost 400 points.

– Early bounce is sold as Fed jawboning cannot overcome Navarro’s China trade comments.

-Government shutdown adds some downside spice, but not a major market obstacle.

-VIX finally starting to breakout on the selling, the last piece of the oversold puzzle.

-Market could flush out now that VIX is breaking higher, but a holiday week may not provide the needed action.

-Embracing the bear market.

Market Summary (continued)

Stocks started higher, DJ30 rallied almost 400 points. The ‘Dow-type’ stocks were rallying, e.g. PG, AEP, MCD. Kind of back to the stocks that rallied and trended higher as NASDAQ struggled.

New York Fed president Williams appeared on CNBC and stated the Fed was not committed to the rate hikes for 2019, clarifying what Powell muddied up in his post-rate hike press conference. The market liked what he said and jumped, pushing the market higher.

After that interview stocks tested. Then more stories hit regarding a government shutdown today as Trump was not giving on the wall, wanting McConnell to dump the Senate rule requiring a filibuster proof number to even bring a bill to the floor for a vote. So, McConnell started calling senators back in. Collins of Maine complained that this was ‘ruining her life.’ Then QUIT! That is your job. It can happen. If you don’t want to do it, then just resign. I am so tired of our elected officials, there to supposedly serve the electorate, complaining when the job calls. This kind of stuff happens. It is in your job description. You accept having your ‘life ruined’ by having to spend part of a holiday in DC. You asked for that. The rest of us voted you in to do that. Do not ruin our lives because you cannot sip some eggnog with cousin Eddie while he wears his black dickey under a thick cream colored sweater.

Okay, Fed worries were somewhat calmed down but a government shutdown caused some worries. Then the real trouble started. Anew.

Read “The Daily” Entire Weekend Summary

Here’s a trade from “The Daily” and insights into our trading strategy:

Chart by StockCharts.com

It was a week to take the upside gain and then reap the reward on the downside plays.

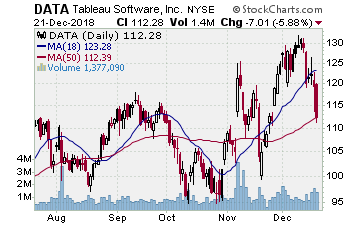

DATA (Tableau Software, Inc.)

Company Profile

DATA suffered the same Monday blues. After hitting a new high late the prior week, it gapped lower Monday. We didn’t wait long when we saw the market weakness, selling the rest of the January $115 strike calls (bought at $6.40) for $13.50, banking at 110% gain.

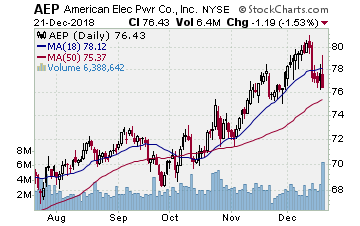

AEP (American Electric Power Company, Inc.)

Company Profile

Monday was the drop for many of the defensive stocks, AEP included. After a great run up the 10 day EMA it was sold through the 10 day EMA and we banked the rest of the January $72.50 options bought at $3.17, selling for $6.50 and banking 105%.

Downside was also starting to pay off:

FFIV (F5 Networks, Inc.)

Company Profile

Bought the puts on 12/15 for $6.95, had to suffer through a 2-day bounce test of resistance, then it rolled over. Sold half the position Friday at $11.85, banking 70%.

NVDA (NVIDIA Corporation)

Company Profile

Bought into NVDA 12/17 with some January $140 strike puts at $8.50. Sold to the initial target Friday and we sold half for $14.25, banking 67%.

SLAB (Silicon Laboratories Inc.)

Company Profile

Bought this one 12/15, picking up some January $85.00 strike puts for $3.40. Sold half Friday at $9.30, banking 170+%.

ULTA (Ulta Beauty, Inc.)

Company Profile

Bought into ULTA downside 12/17 with some January $240.00 strike put options at $9.68. Friday sold half at $15.20 for a 57% gain.

WSM (Williams-Sonoma, Inc.)

Company Profile

Entered this one earlier than the others, on 12/10 as WSM failed a test of the 200 day SMA and continued lower below the 10 day EMA. Picked up some January $55.00 strike puts for $3.75. WSM headed steadily lower, dumping hard Monday, hitting the initial target. We banked some gain at $6.10, 62%. As of Friday the options are trading $8.00 on the bid, a gain of 110+%.

Receive a 2 week trial and if you stay on receive a $30 per month discount!

2) STOCK SPLIT REPORT Here’s a leader play and our current analysis.

Chart by StockCharts.com

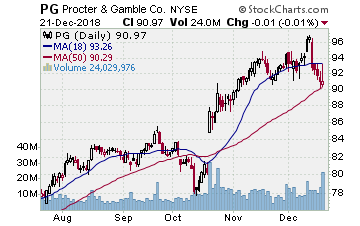

PG (Procter & Gamble–$90.97; -0.01; optionable)

Company Profile

EARNINGS: 01/18/2019

STATUS: 50 day MA test. Similar to AEP, PG had its hiccup when the market sold everything. It has found the 50 day EMA, showing a doji on strong volume Thursday. We want to play it as it bounces back upside off the test. A move to the target lands a 70%ish gain.

Volume: 13.955M Avg Volume: 10.999M

BUY POINT: $91.78 Volume=12M Target=$96.89 Stop=$90.12

POSITION: PG FEB 15 2019 90.00 C – (59 delta)

CHART IMAGE

Learn more about our Stock Split Report and how we have made gains of 321% with our powerful stock split plays!

Save $360 per year on the Stock Split Report! Plus 2 week trial!

Chart by StockCharts.com

3) IH ALERTS

AEP (American Electric–$76.43; -1.19; optionable): Utilities

Company Profile

EARNINGS: 01/24/2019

STATUS: AEP rallied well, then had its hiccup as the rest of the market started to turn over. It has done its test, has come to the 50 day EMA, showing a nice doji at that support. Nice doji and gain on volume Thursday as the market sold. Okay, looks as if this stock has done its test and the market is ready for defense again. As AEP continues back up through the buy point, we move in. A rally to the target lands a 95% gain on the calls.

Volume: 3.477M Avg Volume: 2.683M

BUY POINT: $78.11 Volume=3.2M Target=$82.46 Stop=$76.58

POSITION: AEP FEB 15 2019 77.50 C – (60 delta)

CHART IMAGE

Save $600 per year and enjoy a 2 week trial of our IH Alerts Service!

Chart by StockCharts.com

4) SUCCESS TRADING GROUP–by the MarketFN STG Team

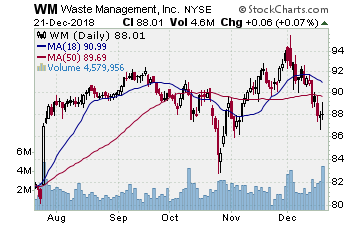

WM (Waste Management, Inc.) Company Profile

Our Success Trading Group members will be looking to enter new positions next week. We have many stocks on our radar including Waste Management, Inc. (Ticker: WM) and The Coca-Cola Company (Ticker: KO).

Our Success Trading Group closed7 years with 0 losses on our Main Trade Table. In fact, we closed 100% winning trades for the calendar years 2016, 2015, 2013, 2012, 2011, 2010 and 2009 (we still have 1 open position from 2017 (all others were winners) and 1 trade that we opened in 2014 was closed as a losing trade). All of these trades are posted on our Main Trade Table for your review during your free membership trial period.

Get Our Next Trade Free – Save $50 per month! Details Here.

Chart by StockCharts.com

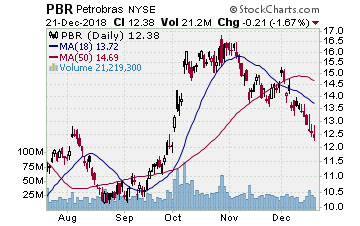

5) COVERED CALL PLAY

PBR – Petróleo Brasileiro S.A. – Petrobras is currently trading at $12.38. The February $12.00 Calls (PBR20190216C00012000) are trading at $1.13. That provides a return of about 7% if PBR is above $12.00 on expiration Friday in February.