Weekend Issue for 8/11

THE WEEKEND ISSUE

Informing Investors Around The World

Read In All 50 States And Over 100 Countries

Weekend Newsletter for

August 11, 2019

Table Of Contents

1) MARKET SUMMARY from THE DAILY

2) IH ALERTS

3) SUCCESS TRADING GROUP

4) COVERED CALL SERVICE

1) MARKET SUMMARY:

Excerpted from Thursday’s paid content of “The Daily” by Jon Johnson at InvestmentHouse.com. To get his latest information and his daily content, click here now to receive a two-week trial and save $30/month. (You won’t find this offer on the Investment House website. It is exclusively for The Weekender subscribers!)

Revival After the Fall.

Stocks start strong, get stronger into the close in terms of point gains, solid breadth and volume.

Just when the pressure relented, the Trump Administration held off on licenses for selling to Huawei.

The fact that futures tumbled and then recovered nearly all the losses shows the presence of good market resilience thus far.

All eyes are on the People’s Bank of China (PBOC) to set the value of the yuan. Are you serious?

Market Summary (continued from above)

A good surge that was part of the three day move that lasted though Tuesday and the first part of Wednesday was not that positive because the surge pushed the indices near those levels of potential resistance. While we were buying for sure because of the strong moves, we now have to keep an eye on those April and May highs. The S&P 500 is already within spitting distance and the DJ30 is not far off from those levels. Thus, we were both buying and looking for a continued surge in order to take some short term profits. Then, we plan to see what happens when the NASDAQ hits resistance. Those were strong days indeed and no good day goes unpunished.

After trading hours had ended, the U.S. federal government announced it was “holding off” on a decision to give licenses that would allow U.S. companies to resume business with Huawei. This decision was made in response to China deciding to halt purchases of U.S. agricultural goods. It could be a case of tat for tit or tat for tit. I’m not sure which iteration the two sides are on right now.

Now everyone is waiting to see where the self-proclaimed “non-currency manipulator” Chinese government will manipulate its currency to, i.e. where it sets the peg. Will it retaliate with a lower peg or will it surprise us all again with a higher peg as it did on Thursday? Only President Xi and his Communist Party politburo know.

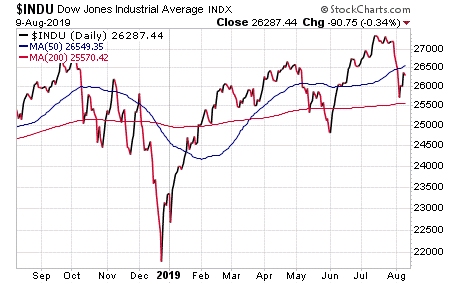

DJ30: There was a solid gap and run here, even though the index is still well off 26,650 with room to run. While the Dow has some good momentum, Apple (AAPL), Caterpillar Inc. (CAT) and other China-related stocks are under some pressure post-close.

S&P 500: The S&P 500 is already at the 50-day moving average (MA) and closed at 2,938, just below the 2,950 that it achieved during the early May high. While this was a bigger move than was anticipated, this is okay as S&P 500 still has a strong volume, impressive breadth and solid leadership. It could easily cruise higher to between 2,960 and 2,980 on the strong momentum and the rally that lasted through Friday. Now, it has to deal with the Huawei issue. Futures are, however, recovering quite nicely.

NASDAQ: Another solid gap and run by a large-cap index ended with the NASDAQ closing just over the 50-day estimated moving average (EMA). As it closed at 8,039 and is looking as some serious resistance at 8,150, this course of action has left the NASDAQ room to continue higher. Shares of PowerShares QQQ Trust (QQQ) sold off aggressively after the Huawei news and then staged a very solid recovery to gain back at least half the after hours drop.

NOTE: The figures and information above are from the 8/8 report.

NOTE: The videos are from the 8/7 report.

Here are two trades from “The Daily,” offering insights into our trading strategy and the targets that we have hit this week:

Chart by StockCharts.com

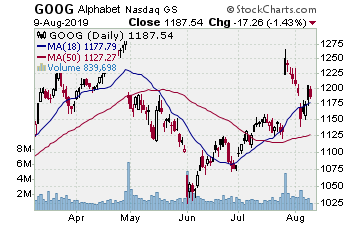

GOOG (NASDAQ: Google)

Company Profile

Flag. GOOG gapped upside on earnings after gapping lower on earnings in April. Since something of an island reversal is taking shape and since the pullback to the 10-day EMA is testing the gap, it looks as if GOOG is giving us another opportunity to make money.

It already made us a sackful on the earnings. Now, we want a post-earnings play that counterpunches off the pullback to test the earnings gap. Note how it is holding just over the late April lower gap point from earnings. As this is a natural support level for the reversal, we want to move in as GOOG makes the break back up on some good volume. A move to the target will give us a gain of around 50% on the call options.

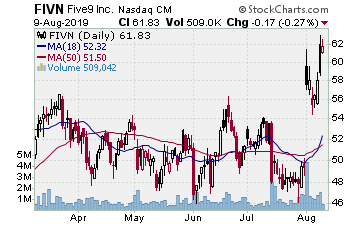

FIVN (NASDAQ: Five9)

Company Profile

Chart by StockCharts.com

FIVN gapped sharply higher on earnings, jumped off the 200-day simple moving average (SMA) and cleared a triangle. After that Thursday upside gap, it tested and came back to the June high.

On Wednesday, FIVN surged on a strong volume in what has been a solid move.

We want to move in as it continues upward in order to capture what we can. A rally to the target will give us a gain of 10% on the stock and 55% on the options.

Targets Hit This Week:

Netflix Inc. (NASDAQ:NFLX): In July, NFLX’s earnings gapped the stock through the 200-day simple moving average (SMA). By that time, we were on the watch for a counterpunch play that would enable us to play off the earnings. The rebound was logical and we played that move with some September calls. We also played a further downside move after NFLX tested the 200-day average. The stock then rallied right back up to the 200-day SMA and then stalled with a doji on the candlestick chart. We put the play on the report and began looking for a drop back down from there. Since there were some upside gaps from January, we thought we could play for that as a best case scenario and could make good money without going that far. Since NFLX started lower from the 200-day SMA, we entered on 8/1 with some September $320 put options at $15.00. Then NFLX steadily declined into this week and undercut the prior low with a gap lower on Thursday. The situation looked great. Then, the market started to reverse and NFLX began to form a doji. With the overall market reversing and the fact that we already had a decent gain built in, we opted to take the gain by selling the puts for $25.80. In the end, we banked a nice 70% gain.

McDonald’s Inc. (NYSE:MCD): After the lurch lower in the market, some stocks still held their support. MCD, Big Macs and all, held over the 50-day EMA and moved upside when most of the market moved lower on Tuesday. We saw that, put it on the report that night and moved in when MCD continued higher Wednesday. This was not a buy and wait forever play as we believe that the market is in a problematic position right now. Thus, upside plays are required to have quite realistic targets that donât require a lot of movement in order to make good gains. We bought October $220 call options for $4.00. While this is perhaps a bit far out, we also realize that even in times of weaker economic activity, people still like the MCD bonus fries. MCD moved higher Wednesday and then was up again on Thursday. On Friday, when much of the market was struggling after early gains, MCD was up and hit our initial target. We sold half the position for $6.05 and banked just over 50%. This is fairly decent for less than three days.

Travelers Companies Inc. (NYSE:TRV): Similar to NFLX, TRV gapped below support at the 50-day MA in late July and then mounted a recovery to test the move. It moved up to the 50-day MA and then threw a tombstone doji. We saw that and put it on the report on 7/29. After it then broke lower during the next session, we moved in with September $145.00 put options at $3.60 since the stock was at $147.62. Then TRV slid lower again even though it bounced on 8/2. That was a one-day bounce, however, and during the next session (Monday), TRV gapped lower in what has been a typical pattern during weak Mondays as of late. That move hit our target and we sold the options for $6.33, banking a nice 75% gain.

Receive a two week trial and if you stay on receive a $30 per month discount!

Chart by StockCharts.com

2) IH ALERTS

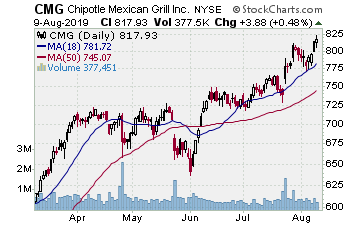

NASDAQ:CMG CMG (Chipotle Mexican Grill–$792.21; +1.78; optionable)

Company Profile

EARNINGS: 10/22/2019

STATUS: After earnings and a good four-session move into Monday, CMG came back to fill the Monday gap and also tested the rising 10-day EMA on Thursday and Friday. The fact that there was a nice pair of doji to end the week indicates that the pullback is almost over. Clearly, CMG keeps — cooking literally and figuratively — even if the overall market is struggling. We want to move in as CMG breaks higher through our entry point. A move to the target will give us a gain of around 50% on the call options.

VOLUME: 402.447K Avg Volume: 470.445K

BUY POINT: $794.82 Volume=650K Target=$844.94 Stop=$778.12

POSITION: CMG NOV 15 2019 800.00C — (52 delta)

Save $600 per year and enjoy a two week trial of our IH Alerts Service!

Chart by StockCharts.com

3) SUCCESS TRADING GROUP

— by the MarketFN STG Team

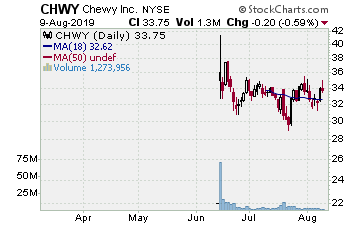

NYSE:CHWY (Chewy, Inc.)

Company Profile

Our Success Trading Group members scored another winning trade when we closed out a position in Chewy, Inc. (NYSE:CHWY). We are watching several other stocks and are looking forward to trading next week.

Our Success Trading Group closed seven years with zero losses on our Main Trade Table. In fact, we closed 100% winning trades for the calendar years 2016, 2015, 2013, 2012, 2011, 2010 and 2009. We still have one open position from 2017 (all others were winners) and one trade that we opened in 2014 but was closed as a losing trade.

All of these trades are posted on our Main Trade Table for your review during your free membership trial period.

Get Our Next Trade Free – Save $50 per month! Details Here.

Chart by StockCharts.com

4) COVERED CALL PLAY

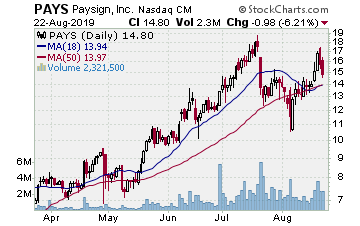

NASDAQ:PAYS — Paysign Inc. is currently trading at $13.06. The September 21 $12.50 Calls (PAYS20190921C00012500) are trading at $2.15. That provides a return of about 17% if PAYS is above $12.50 by the time of the expiration.

Learn more about our Covered Call Tables

PREMIUM SERVICES

IH Alerts: InvestmentHouse.com’s Best of The Best Plays!

Stock Split Report: Forbes.com Best of the Web

Covered Calls: Allowed in your IRA – Energize your portfolio!

The Daily: “The Daily” is a must read for all investors!

Success Trading Group: seven years without a trading loss!

The foregoing is commentary for informational purposes only. All statements and expressions are the opinions of Online Investment Services, LP., or Split Ventures, Ltd. This information is not meant to be a solicitation or recommendation to buy, sell, or hold securities. We are not licensed or registered in the securities industry. The information presented herein and on the related web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. The security portfolios of writers for this issue may, in some instances, include securities mentioned herein and on the related web site. Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ materially due to many factors. No one associated herewith receives compensation in any manner from any of the companies that are discussed in this newsletter or on the related websites.